In today’s rapidly evolving digital landscape, businesses are constantly seeking innovative ways to enhance efficiency and decision-making. Augmented Reality (AR) is emerging as a game-changer in various industries, and accounting is no exception. By overlaying digital information onto the physical world, AR technology is transforming traditional financial management processes, making data visualization more interactive, audits more efficient, and financial reporting more intuitive. This article explores how AR is revolutionizing accounting, improving accuracy, streamlining workflows, and reshaping the future of financial analysis.

Understanding Augmented Reality in Accounting

What is Augmented Reality (AR)?

Augmented Reality (AR) is a transformative technology that enhances the physical world by overlaying digital content—such as images, text, animations, and 3D objects—onto real-world environments. Unlike traditional computing interfaces, which require users to interact with digital information on separate screens, AR integrates digital elements directly into a user’s surroundings in real time. This immersive experience enables a more interactive and intuitive way of engaging with data, making AR a powerful tool in industries ranging from entertainment and healthcare to education and finance.

How AR Works

AR technology relies on a combination of hardware and software to function effectively. The key components include:

- Hardware: Devices such as smartphones, tablets, AR smart glasses, and headsets (e.g., Microsoft HoloLens or Magic Leap) serve as platforms for displaying AR content. These devices use cameras and sensors to scan the environment and accurately position digital overlays.

- Software: AR applications and platforms process real-world input and generate digital augmentations in response. AR software leverages artificial intelligence (AI), computer vision, and cloud computing to enhance accuracy and responsiveness.

- Tracking & Interaction: AR systems use marker-based (QR codes or images) or markerless (GPS, LiDAR, or SLAM technology) tracking methods to detect surfaces and objects in real-world settings. Users can interact with AR elements through touch, voice commands, or gestures.

Key Differences: AR vs. VR vs. MR

While AR is often discussed alongside Virtual Reality (VR) and Mixed Reality (MR), each technology has distinct characteristics:

- Augmented Reality (AR): AR enhances the real world by adding digital elements without replacing it. Users remain aware of and interact with their physical surroundings.

- Virtual Reality (VR): VR immerses users in a fully digital environment, blocking out the real world completely. This is commonly used for gaming, simulations, and virtual training.

- Mixed Reality (MR): MR is a hybrid of AR and VR, where digital objects can interact with real-world environments and be manipulated by users in a more immersive way.

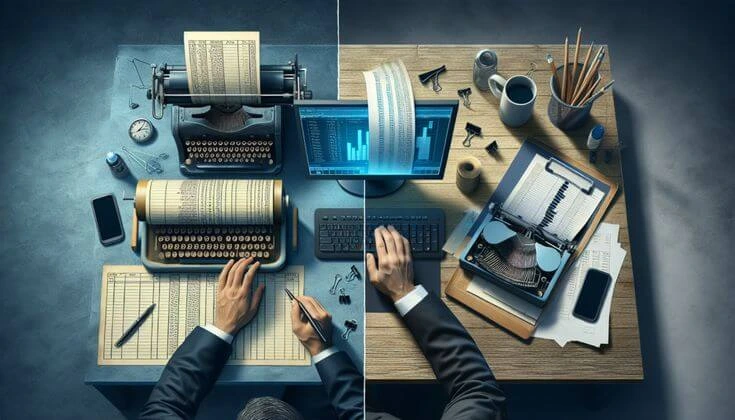

The Role of AR in Digital Transformation

AR is a crucial component of digital transformation, offering businesses new ways to visualize data, train employees, and enhance productivity. Unlike traditional digital tools—such as spreadsheets, dashboards, and AI-driven analytics—AR provides a more interactive and spatial understanding of information. This capability is especially valuable in industries like accounting, where AR can revolutionize financial data visualization, improve audits, and streamline financial decision-making processes.

As AR technology continues to evolve, its applications in business, finance, and accounting will expand, unlocking new possibilities for efficiency, accuracy, and innovation.

The Role of AR in Financial Data Visualization

In the finance and accounting sectors, data visualization plays a crucial role in interpreting complex financial information, identifying trends, and making informed decisions. Augmented Reality (AR) is revolutionizing traditional financial data visualization by transforming static spreadsheets and reports into interactive, immersive experiences. By integrating AR technology, financial professionals can interact with dynamic 3D models, real-time data overlays, and intuitive dashboards that enhance data analysis and decision-making.

How AR Enhances Financial Data Visualization

- Interactive 3D Financial Models

- AR allows financial analysts and accountants to visualize financial statements, revenue streams, and key performance indicators (KPIs) as 3D holographic models.

- Instead of reviewing static charts on a screen, users can manipulate and explore data in real-world space, making trend analysis more intuitive.

- Real-Time Data Overlays

- AR applications can overlay real-time financial data onto physical documents or office environments.

- For example, by pointing an AR-enabled device at a printed balance sheet, users can see live updates, historical comparisons, or predictive analytics overlaid on the document.

- Improved Trend Analysis & Forecasting

- AR enables financial teams to identify patterns and trends more effectively by using spatial visualizations.

- By walking through an AR-generated financial timeline, professionals can see past performance, current status, and projected outcomes in an immersive format.

- Enhanced Collaboration & Decision-Making

- Financial teams, executives, and stakeholders can collaborate using AR-powered dashboards, even in remote settings.

- AR meeting rooms and virtual financial presentations allow teams to interact with financial data in a shared, immersive space, improving engagement and comprehension.

- Augmented Financial Reports & Audits

- AR can streamline financial audits by overlaying critical data points, annotations, and compliance alerts onto financial records.

- Auditors can use AR tools to verify transactions, detect anomalies, and cross-check documents without sifting through extensive paperwork manually.

Real-World Applications of AR in Finance

- Investment & Portfolio Management: Investors can use AR interfaces to visualize portfolio performance, risk analysis, and asset allocation through 3D charts and projections.

- Corporate Finance & Budgeting: CFOs and financial planners can review budgeting scenarios using AR, adjusting variables in real-time to assess potential financial outcomes.

- Accounting & Compliance: Accountants can use AR-powered tools to ensure compliance with regulations by highlighting discrepancies and providing real-time audit insights.

How AR is Changing the Accounting Landscape

Augmented Reality (AR) is revolutionizing the accounting industry by transforming traditional processes, improving efficiency, and enhancing data accuracy. By integrating AR into financial management, accountants can visualize complex financial data in real-time, conduct audits more efficiently, and streamline collaboration between teams. This shift is redefining how accounting professionals interact with financial information, making the entire process more interactive, insightful, and automated.

Key Ways AR is Transforming Accounting

1. Enhanced Financial Data Visualization

- AR allows accountants to interact with financial data through immersive 3D models instead of static spreadsheets and reports.

- By overlaying real-time financial data onto physical documents or office spaces, professionals can gain deeper insights into cash flow, revenue trends, and balance sheets.

- AR dashboards provide a more intuitive representation of financial metrics, making it easier to identify patterns and potential risks.

2. More Efficient & Accurate Auditing

- Auditors can use AR to scan and verify financial documents instantly, reducing the need for manual cross-checking.

- AR-powered audit tools can overlay compliance information, highlight discrepancies, and flag potential fraud risks in real time.

- Remote auditing becomes more effective as AR enables auditors to interact with financial data and documents in a virtual collaborative space.

3. Streamlining Data Entry & Error Detection

- AR can automate data entry by integrating with AI-powered recognition systems that extract financial data from invoices, receipts, and contracts.

- Accountants can use AR overlays to detect inconsistencies or missing information, reducing human errors in financial reporting.

- AR-driven automation helps speed up bookkeeping tasks, allowing accountants to focus on strategic decision-making rather than manual data entry.

4. Improving Training & Onboarding for Accountants

- AR provides immersive training environments where new accountants can interact with real-world financial scenarios in a virtual setting.

- AR tutorials can guide trainees through complex accounting principles, such as tax calculations, financial forecasting, and auditing procedures, in an engaging and hands-on manner.

- Real-time AR guidance helps professionals learn and apply new accounting software without extensive in-person training.

5. Facilitating Remote Collaboration & Decision-Making

- AR enables accountants and financial teams to collaborate in virtual workspaces, where they can review financial reports, adjust budget projections, and analyze cash flow in a shared AR environment.

- Executives and decision-makers can interact with AR-powered financial presentations, improving communication and strategy planning.

- Remote financial consultations become more dynamic as AR allows professionals to share and manipulate financial data interactively.

Real-World Applications of AR in Accounting

- Tax Preparation & Compliance: AR simplifies tax calculations by overlaying tax brackets, deductions, and compliance guidelines onto financial documents.

- Budget Forecasting & Planning: Accountants can use AR projections to simulate different financial scenarios and make data-driven decisions.

- Expense & Asset Management: Businesses can visualize expenses, liabilities, and asset performance in real time using AR-enhanced reports.

Key Applications of AR in Financial Management

AR for Real-Time Bookkeeping & Data Entry

Bookkeeping and data entry are essential yet time-consuming tasks in accounting. Augmented Reality (AR) is revolutionizing these processes by introducing automation, real-time data visualization, and interactive financial management tools. By leveraging AR, businesses and accountants can streamline bookkeeping workflows, reduce human errors, and enhance the accuracy of financial reporting.

How AR is Transforming Bookkeeping & Data Entry

1. Automated Data Capture & Entry

- AR-powered applications can scan and extract financial data from invoices, receipts, and bank statements in real time.

- Optical Character Recognition (OCR) and AI-driven AR tools allow accountants to capture handwritten or printed financial data and convert it into digital records instantly.

- This reduces the need for manual data entry, minimizing errors and improving efficiency.

2. Real-Time Financial Record Updates

- AR enables real-time synchronization of financial transactions with accounting software.

- Accountants can use AR overlays to view live updates on expenses, revenues, and account balances without navigating through multiple spreadsheets or databases.

- Businesses can monitor financial health dynamically, ensuring up-to-date records for decision-making.

3. Interactive & Intuitive Bookkeeping Dashboards

- AR replaces static financial reports with interactive 3D dashboards where accountants can manipulate and analyze data visually.

- Users can zoom in on specific transactions, categorize expenses, and compare financial trends through an AR interface.

- This spatial representation of financial data enhances understanding and facilitates better financial planning.

4. Error Detection & Anomaly Identification

- AR-powered bookkeeping systems highlight discrepancies, duplicate entries, and unusual transactions automatically.

- Accountants can overlay compliance rules onto financial data, ensuring adherence to accounting standards and tax regulations.

- By visualizing financial anomalies through AR, fraud detection and risk assessment become more efficient.

5. Hands-Free Accounting with AR Smart Glasses

- Smart glasses equipped with AR can allow accountants to manage financial records while multitasking.

- By simply looking at a receipt or document, AR can display relevant financial insights, categorize expenses, and suggest appropriate ledger entries.

- This hands-free approach reduces workload and increases productivity.

Real-World Applications of AR in Bookkeeping & Data Entry

- Retail & E-commerce: AR-powered bookkeeping systems can automatically record sales, track inventory expenses, and update accounting books in real time.

- Corporate Finance: Large businesses can use AR dashboards for real-time financial monitoring, improving reporting accuracy.

- Small Businesses & Freelancers: AR tools simplify bookkeeping for non-accountants by automating data capture and financial tracking.

AR in Auditing & Compliance

Auditing and compliance are critical aspects of financial management, ensuring that businesses adhere to regulations, detect fraud, and maintain financial transparency. Augmented Reality (AR) is revolutionizing these processes by introducing real-time data visualization, automation, and enhanced collaboration. With AR, auditors can conduct more efficient, accurate, and interactive audits while ensuring regulatory compliance with minimal manual effort.

How AR is Transforming Auditing & Compliance

1. Real-Time Financial Data Visualization

- AR allows auditors to overlay financial data on physical documents, providing instant insights into transactions, balances, and reports.

- Instead of analyzing static spreadsheets, auditors can interact with dynamic 3D models that highlight trends, discrepancies, and anomalies.

- Live financial dashboards powered by AR help auditors track real-time compliance metrics, reducing the risk of oversight.

2. Automated Document Verification & Risk Assessment

- AR integrates with AI-powered data recognition tools to scan and verify financial records automatically.

- Auditors can use AR overlays to identify missing documents, inconsistencies in financial statements, and potential fraud indicators.

- Risk assessment becomes more efficient as AR highlights high-risk transactions and non-compliant activities instantly.

3. Streamlining Compliance Checks & Regulatory Audits

- AR-enabled compliance tools can overlay tax codes, financial regulations, and accounting standards onto financial records, ensuring adherence to legal requirements.

- Auditors can interact with AR-driven compliance checklists, making sure that all regulatory steps are followed in real time.

- Automated AR alerts notify businesses of potential compliance issues before they escalate into legal problems.

4. Enhancing Remote Auditing & Collaboration

- AR-powered virtual audit rooms allow auditors and financial teams to collaborate remotely in an interactive environment.

- Businesses can share financial reports in AR, enabling auditors to examine records, leave annotations, and suggest corrections without being physically present.

- This approach reduces audit time and improves accessibility for multinational corporations and remote teams.

5. Fraud Detection & Anomaly Identification

- AR enhances fraud detection by overlaying AI-driven anomaly detection models onto financial transactions.

- Suspicious activities, such as duplicate payments, unauthorized transactions, or unusual expense claims, can be flagged in real time.

- Auditors can visualize financial flows in a 3D AR environment, making it easier to track money movements and detect irregularities.

Real-World Applications of AR in Auditing & Compliance

- Corporate Audits: Large enterprises use AR to streamline financial audits, ensuring compliance with global accounting standards.

- Tax Auditing: Tax professionals leverage AR to verify tax filings, cross-check deductions, and prevent underreporting or overpayments.

- Regulatory Compliance for Banks & Financial Institutions: Banks use AR-driven compliance monitoring to ensure adherence to anti-money laundering (AML) and financial reporting regulations.

AR-Driven Financial Forecasting & Budgeting

Financial forecasting and budgeting are essential for businesses to plan for the future, allocate resources efficiently, and make informed decisions. Augmented Reality (AR) is revolutionizing these processes by introducing immersive data visualization, predictive modeling, and real-time scenario analysis. By leveraging AR-driven forecasting tools, businesses can gain deeper insights into financial trends, anticipate market changes, and optimize budgeting strategies with greater accuracy.

How AR is Transforming Financial Forecasting & Budgeting

1. Immersive Financial Data Visualization

- AR replaces traditional spreadsheets and static reports with interactive 3D financial models.

- Decision-makers can visualize revenue projections, cash flow trends, and expense breakdowns in real-time AR dashboards.

- Instead of analyzing rows of numbers, executives can interact with financial data through intuitive overlays, improving comprehension and strategic planning.

2. Real-Time Scenario Analysis & Forecasting

- AR enables businesses to simulate different financial scenarios by adjusting variables such as sales growth, operational costs, and market conditions.

- Accountants and financial analysts can use AR tools to predict potential risks and opportunities based on historical data and predictive AI models.

- What-if analysis becomes more efficient as businesses can see immediate impacts of financial decisions in a dynamic AR environment.

3. Automated Budget Allocation & Optimization

- AR-powered budgeting tools assist in allocating resources more effectively by visualizing spending patterns and identifying areas of improvement.

- Businesses can use AR overlays to compare planned budgets with actual expenses, ensuring financial discipline.

- AI-driven AR systems provide recommendations for cost reduction, investment opportunities, and profitability maximization.

4. Enhancing Collaboration in Financial Planning

- AR-driven virtual meeting spaces allow financial teams, managers, and stakeholders to interact with budget models in a shared augmented environment.

- Teams can collectively analyze financial forecasts, adjust budget plans, and make real-time strategic decisions.

- This collaborative approach reduces miscommunication and improves alignment between different departments.

5. Improved Risk Management & Market Adaptation

- AR-enhanced financial forecasting helps businesses identify market trends and economic shifts early.

- Companies can visualize risk exposure, such as currency fluctuations or supply chain disruptions, and proactively adjust their financial strategies.

- By integrating AR with AI and big data analytics, businesses gain a competitive advantage in financial planning.

Real-World Applications of AR in Financial Forecasting & Budgeting

- Corporate Finance: Large enterprises use AR to forecast revenue, manage expenses, and optimize investment strategies.

- Retail & E-commerce: Businesses leverage AR to predict sales trends and adjust marketing budgets dynamically.

- Startups & SMEs: Small businesses use AR-powered tools for intuitive financial planning and resource allocation.

Benefits of Using AR Technology in Accounting

Improved Efficiency & Accuracy with AR in Accounting

Augmented Reality (AR) is revolutionizing the accounting industry by enhancing efficiency and accuracy in financial processes. By integrating AR technology with accounting software, businesses can automate repetitive tasks, reduce human errors, and provide real-time insights into financial data. This transformation allows accountants and financial professionals to work more effectively, make better decisions, and ensure compliance with regulations.

How AR Improves Efficiency & Accuracy in Accounting

1. Automation of Data Entry & Processing

- AR-powered systems use Optical Character Recognition (OCR) and AI-driven automation to scan and extract financial data from invoices, receipts, and bank statements.

- This minimizes manual data entry errors and speeds up bookkeeping processes.

- AR-driven automation ensures that financial records are updated in real time, improving accuracy and reducing workload.

2. Real-Time Financial Insights & Analysis

- AR overlays allow accountants to interact with financial data in an immersive 3D environment.

- Instead of relying on static spreadsheets, AR-driven dashboards provide real-time updates on cash flow, expenses, and revenue projections.

- This real-time access enhances decision-making and helps businesses respond to financial challenges more quickly.

3. Error Detection & Anomaly Identification

- AR technology can highlight discrepancies, duplicate transactions, or missing entries by visually marking them in financial reports.

- AI-integrated AR systems detect inconsistencies in tax filings, financial statements, and compliance reports, reducing audit risks.

- By visualizing financial trends and anomalies in real time, accountants can proactively address issues before they escalate.

4. Enhanced Collaboration & Workflow Optimization

- AR-powered virtual workspaces enable accountants, auditors, and financial teams to collaborate remotely in an interactive environment.

- Teams can review financial documents, adjust budgets, and approve transactions through AR interfaces, reducing communication delays.

- This improves workflow efficiency and ensures that financial processes run smoothly.

5. Faster Decision-Making & Strategic Planning

- With AR-driven data visualization, financial professionals can instantly assess financial health, identify risks, and adjust strategies accordingly.

- Businesses can run scenario analyses in AR to evaluate the impact of different financial decisions before implementing them.

- This improves long-term financial planning and helps organizations stay ahead of market changes.

Real-World Applications of AR for Efficiency & Accuracy in Accounting

- Corporate Finance: AR streamlines financial reporting and forecasting for large enterprises.

- Tax Compliance: AR highlights tax discrepancies and automates regulatory compliance checks.

- Small Businesses: AR-powered bookkeeping tools simplify financial management for entrepreneurs and SMEs.

Better Decision-Making for Financial Managers with AR

Financial managers play a crucial role in shaping an organization’s financial health by making strategic decisions based on data analysis, risk assessment, and forecasting. Augmented Reality (AR) is transforming the way financial managers interpret and interact with financial data, leading to more informed and confident decision-making. By providing immersive data visualization, real-time analytics, and interactive financial models, AR enhances financial managers’ ability to optimize budgets, mitigate risks, and drive business growth.

How AR Enhances Financial Decision-Making

1. Interactive & Immersive Data Visualization

- Traditional financial reports and spreadsheets can be complex and difficult to interpret. AR replaces them with interactive 3D models that allow financial managers to visualize revenue trends, expense patterns, and profitability projections.

- AR-driven dashboards enable financial managers to explore different data layers dynamically, offering deeper insights into financial performance.

- By using AR to interact with key financial metrics, decision-makers can quickly identify trends, opportunities, and areas of concern.

2. Real-Time Financial Analysis & Scenario Planning

- AR allows financial managers to conduct real-time financial analysis by overlaying data-driven insights onto physical environments or digital workspaces.

- They can run “what-if” scenarios to predict the impact of different financial decisions, such as adjusting investment strategies, reallocating budgets, or optimizing costs.

- By simulating multiple financial scenarios in AR, businesses can make proactive, data-backed decisions with greater accuracy.

3. Improved Budgeting & Resource Allocation

- AR assists financial managers in budget allocation by displaying spending patterns, cash flow movements, and cost projections in an intuitive format.

- AR-powered AI recommendations help managers allocate resources efficiently by identifying areas where cost-cutting or investment can improve financial health.

- Dynamic AR interfaces allow financial managers to tweak budgets and instantly see the potential impact on profitability and operational efficiency.

4. Enhanced Risk Management & Fraud Detection

- AR integrates with AI-powered fraud detection systems to highlight anomalies, suspicious transactions, or financial discrepancies in real time.

- Risk assessment models are enhanced with AR by allowing managers to visualize financial risks through heatmaps, trend analyses, and anomaly detection overlays.

- This proactive approach minimizes financial losses and strengthens internal controls.

5. Faster & More Collaborative Decision-Making

- AR-driven virtual meeting rooms enable financial teams to collaborate seamlessly, regardless of location.

- Financial managers can interact with shared AR dashboards, making real-time adjustments to financial strategies while ensuring alignment across departments.

- By facilitating faster decision-making processes, AR reduces bottlenecks and enhances overall business agility.

Real-World Applications of AR for Financial Decision-Making

- Corporate Financial Strategy: AR helps CFOs and finance teams analyze large-scale financial data to drive long-term business strategies.

- Investment Planning: Portfolio managers use AR to simulate different investment scenarios and assess risk-return trade-offs visually.

- Small & Medium Businesses: SMEs leverage AR-powered financial tools to simplify budgeting and improve decision-making accuracy.

Enhanced Collaboration in Finance Teams with AR

Effective collaboration among finance teams is essential for ensuring accurate financial reporting, strategic planning, and efficient decision-making. However, traditional financial collaboration often faces challenges such as communication gaps, data silos, and inefficient document-sharing processes. Augmented Reality (AR) is transforming how finance teams interact, collaborate, and analyze financial data by providing immersive, real-time, and interactive environments.

AR-powered financial collaboration tools enable teams to work together seamlessly, whether they are in the same office or working remotely. By integrating AR with cloud-based accounting systems, AI-driven analytics, and real-time visualization, finance teams can make more informed decisions and improve overall efficiency.

How AR Enhances Collaboration in Finance Teams

1. Real-Time Financial Data Sharing & Visualization

- AR-powered dashboards allow finance teams to visualize and interact with financial data in real-time.

- Instead of static spreadsheets or reports, financial data is presented in interactive 3D charts, graphs, and models that team members can manipulate collaboratively.

- Teams can analyze financial trends, budgets, and forecasts together, making it easier to align on key financial strategies.

2. Virtual Financial Meeting Rooms

- AR enables virtual financial meetings where teams can interact with financial reports and models in a shared augmented space.

- Participants can review, annotate, and discuss financial data in real time, improving decision-making efficiency.

- This is particularly useful for remote finance teams, allowing them to collaborate as if they were in the same room.

3. Streamlined Budgeting & Financial Planning

- Finance teams can use AR to co-develop budgets and financial forecasts, adjusting figures dynamically while viewing their impact in real time.

- AR-assisted financial planning tools allow multiple stakeholders to contribute simultaneously, reducing back-and-forth communication delays.

- Collaborative AR tools help finance teams align their strategies across departments, ensuring more accurate financial projections.

4. Improved Compliance & Risk Management

- AR facilitates real-time compliance monitoring by overlaying regulatory checklists and risk assessments on financial documents.

- Teams can collaborate on risk analysis by visualizing potential compliance issues and resolving them collectively.

- AR-driven fraud detection tools help teams work together in identifying and mitigating financial discrepancies.

5. Faster Decision-Making & Workflow Optimization

- By integrating AR with accounting and financial management software, finance teams can streamline approval processes for budgets, invoices, and financial reports.

- AR-powered automated workflows ensure that financial documents are reviewed, approved, and updated in real time, reducing delays.

- Enhanced collaboration enables finance teams to react quickly to financial challenges and make data-driven decisions efficiently.

Real-World Applications of AR in Finance Team Collaboration

- Corporate Finance Teams: AR assists in financial strategy discussions, investment analysis, and performance reviews.

- Audit & Compliance Teams: AR enhances collaboration in identifying regulatory risks and ensuring adherence to financial laws.

- Small Business Accounting Teams: AR simplifies financial discussions among small business owners and accountants by making financial data more accessible.

Challenges and Future of AR in Accounting

Barriers to Adoption in Financial Services

While Augmented Reality (AR) holds significant potential to transform financial services, its widespread adoption faces several barriers. The financial industry is traditionally risk-averse, and implementing cutting-edge technologies like AR requires overcoming challenges related to cost, security, compliance, and user adoption. Understanding these barriers is crucial for financial institutions looking to integrate AR into their operations effectively.

Key Challenges Hindering AR Adoption in Financial Services

1. High Implementation Costs

- Developing and deploying AR solutions require significant investment in software, hardware (such as AR headsets or smart glasses), and integration with existing financial systems.

- Many financial institutions may find it difficult to justify these costs, especially when the return on investment (ROI) is not immediately clear.

- Small and mid-sized businesses (SMBs) may struggle with affordability, limiting AR adoption to large financial firms with greater resources.

2. Data Security & Privacy Concerns

- Financial data is highly sensitive, and AR applications must comply with strict security protocols to protect customer information.

- The integration of AR with real-time financial data poses risks of cyber threats, unauthorized access, and data breaches.

- Financial institutions must ensure that AR platforms follow stringent encryption and cybersecurity measures to mitigate potential vulnerabilities.

3. Regulatory & Compliance Challenges

- The financial sector is one of the most heavily regulated industries, with strict compliance requirements varying across regions.

- AR applications must adhere to financial regulations such as GDPR (General Data Protection Regulation), SOX (Sarbanes-Oxley Act), and PCI DSS (Payment Card Industry Data Security Standard).

- Compliance complexities may slow down AR adoption, as financial institutions need to ensure that AR-driven processes align with legal frameworks.

4. Resistance to Change & User Adoption

- Traditional financial professionals may be hesitant to adopt AR due to a lack of familiarity with the technology.

- Employees may require extensive training to use AR tools effectively, which can lead to resistance and slow adoption rates.

- Clients and customers may also be skeptical about using AR for financial transactions, preferring traditional online banking and face-to-face interactions.

5. Integration with Legacy Systems

- Many financial institutions still rely on legacy infrastructure and outdated software systems that may not be compatible with AR technology.

- Integrating AR with existing banking, accounting, and financial management systems can be complex, requiring significant upgrades or redesigns.

- Without seamless integration, financial firms may struggle to implement AR solutions effectively, leading to operational inefficiencies.

6. Hardware Limitations & Accessibility Issues

- AR experiences are often optimized for specialized hardware like smart glasses, which are not yet widely adopted in financial workplaces.

- Not all users have access to high-performance AR-compatible devices, limiting the reach of AR-driven financial applications.

- Financial institutions need to balance AR adoption with accessibility to ensure a smooth user experience for both employees and customers.

Overcoming These Barriers for Successful AR Implementation

- Investment Justification: Financial institutions must conduct thorough ROI assessments to demonstrate the long-term benefits of AR adoption.

- Enhanced Cybersecurity Measures: Implementing robust encryption, multi-factor authentication, and secure cloud solutions can mitigate data security concerns.

- Regulatory Compliance Strategies: Working closely with regulators and legal teams ensures that AR applications comply with financial industry laws.

- Employee Training & Change Management: Providing training programs and demonstrating AR’s practical benefits can encourage user adoption.

- Gradual Integration with Existing Systems: Adopting AR in stages, starting with non-critical financial processes, can ease the transition and minimize disruptions.

Overcoming Security & Compliance Concerns in AR for Financial Services

As financial institutions explore the potential of Augmented Reality (AR) in accounting, auditing, and financial management, security and compliance remain critical challenges. Given the highly sensitive nature of financial data, organizations must address concerns related to data breaches, regulatory compliance, and fraud prevention before AR can be fully integrated into financial workflows.

Implementing AR in financial services requires a multi-layered approach to security, ensuring that data remains protected while maintaining compliance with global financial regulations. Here’s how organizations can effectively overcome these concerns.

Key Security & Compliance Challenges in AR for Financial Services

1. Data Privacy & Confidentiality Risks

- AR applications in finance often interact with real-time financial data, customer records, and sensitive transactions.

- Unauthorized access to AR-driven financial dashboards could lead to data leaks and financial fraud.

- Financial institutions must ensure that AR solutions comply with privacy laws such as GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), and GLBA (Gramm-Leach-Bliley Act) to protect customer information.

2. Cybersecurity Threats & Fraud Prevention

- AR applications are vulnerable to cyber threats such as hacking, phishing attacks, and malware infiltration if not properly secured.

- The integration of AR with cloud-based accounting platforms increases the risk of cyberattacks targeting financial institutions.

- Fraud detection mechanisms must be integrated into AR financial tools to prevent identity theft, unauthorized transactions, and financial fraud.

3. Regulatory Compliance & Legal Challenges

- Financial institutions operate in a highly regulated environment with complex legal requirements.

- AR-driven financial applications must adhere to compliance standards such as SOX (Sarbanes-Oxley Act), PCI DSS (Payment Card Industry Data Security Standard), and Basel III banking regulations.

- Ensuring AR compliance with financial regulations requires continuous monitoring, legal consultations, and robust documentation.

4. Secure Integration with Existing Financial Systems

- Many financial firms still rely on legacy systems that may not support AR-driven analytics and visualization tools.

- The integration of AR with traditional accounting, banking, and auditing platforms must be secure and seamless to prevent operational vulnerabilities.

- Secure APIs and encrypted data transfers are essential for connecting AR solutions with existing financial infrastructure.

Strategies to Overcome Security & Compliance Concerns

1. Implement Strong Encryption & Data Protection Measures

- Use end-to-end encryption to secure financial data processed through AR applications.

- Ensure AR platforms implement zero-trust security models to authenticate and verify all access requests.

- Leverage blockchain technology to enhance data integrity and prevent financial fraud.

2. Adopt Multi-Factor Authentication (MFA) & Access Controls

- Require MFA for all financial professionals using AR-powered accounting or auditing tools.

- Implement role-based access controls (RBAC) to ensure only authorized personnel can access sensitive financial data.

- Monitor and log all user interactions within AR applications to detect suspicious activities.

3. Stay Compliant with Global Financial Regulations

- Conduct regular compliance audits to ensure AR applications adhere to financial regulations.

- Work closely with regulatory bodies and legal teams to stay updated on changing compliance requirements.

- Use automated compliance monitoring tools to detect and resolve potential compliance violations in real time.

4. Secure AR Infrastructure & Cloud Integrations

- Deploy firewalls, intrusion detection systems (IDS), and AI-driven cybersecurity solutions to protect AR environments.

- Partner with trusted cloud providers that comply with financial security standards such as ISO 27001, SOC 2, and FedRAMP.

- Regularly update AR software to patch vulnerabilities and enhance security resilience.

5. Educate Finance Professionals on AR Security Best Practices

- Train employees on AR security awareness, including recognizing phishing threats and secure data handling.

- Establish clear AR usage policies to prevent unauthorized access to financial systems.

- Conduct security drills and penetration tests to identify weaknesses in AR-powered financial applications.

The Future of Secure & Compliant AR in Financial Services

By implementing robust security frameworks and regulatory compliance strategies, financial institutions can safely adopt AR technology without compromising data integrity. As cybersecurity solutions advance, AR-driven financial applications will become more resilient to threats, fostering trust and confidence in their use.

As a result, AR will continue to revolutionize financial services by enhancing data visualization, improving auditing accuracy, and streamlining real-time bookkeeping, all while maintaining the highest security and compliance standards.

Future Trends in AR for Accounting & Finance

As Augmented Reality (AR) technology continues to evolve, its impact on accounting and finance is expected to grow significantly. AR is reshaping how financial professionals interact with data, enhancing real-time insights, collaboration, and decision-making. Looking ahead, several emerging trends indicate how AR will revolutionize the financial landscape in the coming years.

Key Future Trends in AR for Accounting & Finance

1. AI-Driven AR for Financial Analysis & Decision-Making

- The integration of Artificial Intelligence (AI) with AR will provide real-time predictive analytics, allowing financial professionals to make data-driven decisions with greater accuracy.

- AI-powered AR dashboards will visualize complex financial data, highlight anomalies, and suggest corrective actions.

- Example: Financial managers could use AR glasses to see live financial forecasts and risk assessments overlaid on their workspace.

2. AR-Powered Remote Accounting & Auditing

- With the rise of remote work, AR will enable accountants and auditors to examine financial records and collaborate virtually in immersive environments.

- Financial auditors will be able to conduct virtual site visits using AR overlays without needing physical access to a company’s office.

- Example: An auditor could wear an AR headset to inspect financial statements and compliance documents in an interactive, 3D environment.

3. Blockchain & AR for Transparent Financial Transactions

- Blockchain technology combined with AR will enhance transparency and security in financial transactions.

- Users will be able to view transaction histories, verify asset ownership, and track compliance through AR-enhanced blockchain ledgers.

- Example: An investor using an AR financial app could instantly verify the blockchain-backed history of a digital asset before making a purchase.

4. AR-Driven Smart Financial Assistants

- AR-powered virtual financial assistants will help professionals and consumers manage budgets, investments, and tax filings in real time.

- Voice-activated AR assistants will provide contextual financial guidance, reducing reliance on traditional spreadsheets and manual data entry.

- Example: A CFO could use AR glasses to interact with an AI assistant that provides instant financial summaries and budget recommendations.

5. AR Integration with Digital Banking & Payment Systems

- Banks and financial institutions will adopt AR for interactive banking experiences, allowing customers to visualize transactions and manage finances more intuitively.

- AR-driven payment systems could allow users to make transactions using AR-enabled interfaces, such as scanning digital overlays for instant payments.

- Example: A customer could use their AR glasses to see real-time spending insights and personalized financial advice while shopping.

6. Real-Time AR-Based Tax & Compliance Reporting

- AR will automate tax calculations, compliance checks, and reporting by overlaying real-time tax obligations on financial records.

- Governments and financial regulators may introduce AR-driven compliance tools to simplify tax filings and prevent fraud.

- Example: A business could use AR to instantly verify its tax obligations by scanning invoices and seeing projected liabilities in real-time.

7. AR-Powered Financial Training & Education

- Financial professionals will receive immersive AR-based training to enhance their skills in accounting, risk management, and investment analysis.

- Universities and corporate training programs will adopt AR to simulate financial scenarios and case studies.

- Example: An accounting student could practice auditing a virtual company’s financial records using an interactive AR simulation.

8. Increased Adoption of AR in Wealth & Asset Management

- AR applications will provide real-time portfolio management tools, allowing investors to visualize market trends and risk factors in an intuitive way.

- Wealth management firms will use AR to provide clients with immersive investment insights and scenario analysis.

- Example: An investor could use AR to explore 3D financial models that predict the future performance of different asset classes.

The Road Ahead: A More Interactive & Data-Driven Financial Industry

As AR technology continues to advance, it will become an integral tool for accountants, auditors, financial analysts, and investors. The future of AR in accounting and finance is centered around automation, enhanced data visualization, security, and immersive collaboration, driving a new era of efficiency and innovation in financial management.

Financial institutions that embrace these AR trends early will gain a competitive edge, improving decision-making, security, and customer engagement while reducing operational inefficiencies. The fusion of AR with AI, blockchain, and cloud-based financial platforms will further accelerate this transformation, paving the way for a more interactive, data-driven, and intelligent financial ecosystem.

Conclusion

Augmented Reality (AR) is transforming the accounting and finance industry by enhancing data visualization, automation, and decision-making. As businesses increasingly rely on real-time financial insights, AR provides interactive, immersive, and intuitive solutions that streamline financial management, improve accuracy, and drive efficiency.

The integration of AR in bookkeeping, auditing, compliance, financial forecasting, and collaboration is already proving to be a game-changer. By leveraging AI, blockchain, and cloud computing, AR will continue to evolve, offering even more powerful tools for financial professionals.

Looking ahead, the potential for AR in financial services is immense. As technology advances, businesses that adopt AR-driven solutions early will gain a competitive edge, reducing errors, optimizing workflows, and making more informed financial decisions.

Now is the time for accountants, CFOs, and financial teams to explore how AR can enhance their financial operations. By embracing innovation, businesses can stay ahead of the curve and unlock new opportunities in the ever-evolving financial landscape.

For further reading: